Unlocking the Secrets: Discover the Ultimate Cryptocurrency Wallets You Can't Afford to Miss!

In the rapidly evolving world of cryptocurrencies, the importance of secure storage solutions cannot be overstated. Cryptocurrency wallets serve as the digital equivalent of a bank account, allowing users to send, receive, and store their digital assets safely. With the increasing popularity of cryptocurrencies, having a reliable wallet is essential for anyone looking to participate in this exciting financial landscape. There are various types of wallets available today, each catering to different needs and preferences. From hot wallets that provide quick access to funds, to cold wallets that ensure enhanced security, understanding these options is crucial for making informed decisions. In this article, we'll explore the top crypto wallets on the market, delving into their features and benefits, so you can find the right fit for your cryptocurrency journey.

Understanding Cryptocurrency Wallets

Cryptocurrency wallets are digital tools that allow users to interact with blockchain networks. They store the public and private keys needed to send and receive cryptocurrencies. When you own a cryptocurrency, you don't actually "own" it in the traditional sense; instead, you possess the keys that grant you access to your asset on the blockchain. There are two primary types of wallets: hot wallets and cold wallets. Hot wallets are connected to the internet, making them user-friendly and accessible for daily transactions. However, this also exposes them to potential security threats. On the other hand, cold wallets are offline storage solutions, offering higher security against hacks and unauthorized access. While cold wallets can be less convenient for frequent transactions, they are ideal for long-term investors who prioritize security over accessibility.

Key Features to Look for in a Cryptocurrency Wallet

Choosing the right cryptocurrency wallet involves considering several essential features. Security should be your top priority; look for wallets that offer strong encryption, two-factor authentication, and backup options. The user interface is also crucial; a wallet that is easy to navigate will enhance your experience, especially if you're new to cryptocurrencies. Additionally, support for multiple cryptocurrencies is a significant factor; the best wallets provide compatibility with various digital assets, allowing you to manage your portfolio effectively. Customer support is another important feature; in case of any issues or questions, responsive support can be invaluable. Lastly, consider backup options, as they ensure that you can recover your funds in case of device loss or failure. By assessing these features, you can select a wallet that meets your needs and provides peace of mind.

Top Cryptocurrency Wallets to Consider

When it comes to selecting a cryptocurrency wallet, users have a plethora of options to choose from. One popular category is hot wallets, which are ideal for those who prioritize convenience. These wallets allow for quick transactions and easy access to funds, making them suitable for active traders. Users often appreciate the seamless integration with exchanges and the ability to manage multiple cryptocurrencies in one place. However, it’s essential to remember that the convenience they offer comes with potential risks, so implementing additional security measures is advisable. On the other hand, cold wallets are the gold standard for security-conscious users. These wallets store your assets offline, making them immune to online threats. They are particularly well-suited for long-term investors who do not require immediate access to their funds. Cold wallets often come in the form of hardware devices or paper wallets, providing an excellent solution for safeguarding substantial investments. By understanding the benefits and limitations of both hot and cold wallets, you can make an informed decision that aligns with your investment strategy.

Hot Wallets

Hot wallets, often favored by active traders, provide a user-friendly interface that allows for immediate access to funds. They are accessible via various devices, including smartphones and computers, making it easy to manage your cryptocurrencies on the go. The real-time transaction capabilities are a significant advantage for users looking to capitalize on market fluctuations. However, the ease of access also comes with heightened security risks, as these wallets are connected to the internet. To mitigate these risks, users should implement strong passwords, enable two-factor authentication, and avoid sharing sensitive information. My friend who is an avid trader swears by his hot wallet for its convenience, although he remains cautious and regularly updates his security settings.

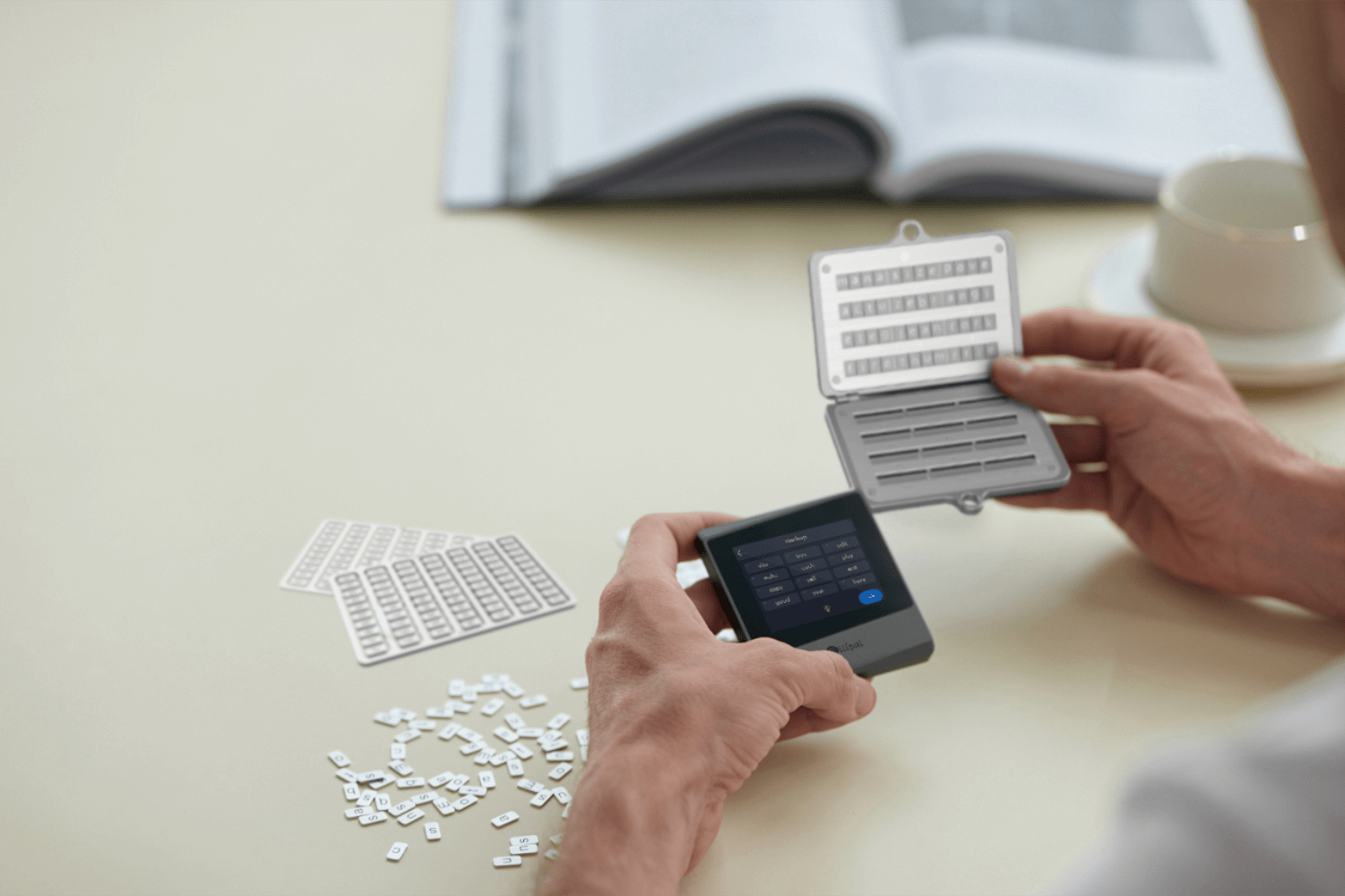

Cold Wallets

For those who value security above all else, cold wallets are the ideal choice. These wallets are not connected to the internet, making them immune to hacking attempts and other cybersecurity threats. Users often rely on cold wallets for long-term storage of their digital assets, as they provide a safe haven for significant investments. The process of setting up a cold wallet may involve a few extra steps compared to hot wallets, but the peace of mind it offers is unparalleled. My cousin, who is a long-term investor, uses a hardware cold wallet to store his cryptocurrencies, and he appreciates knowing that his assets are safe from online threats. The importance of offline storage cannot be overstated, especially as the cryptocurrency market continues to grow and attract more attention.

Choosing the Right Wallet for Your Needs

In conclusion, selecting the right cryptocurrency wallet is a crucial step in your cryptocurrency journey. Whether you opt for a hot wallet for its convenience or a cold wallet for its security, understanding the features and benefits of each type will help you make an informed decision. Remember to prioritize security, accessibility, and compatibility with various cryptocurrencies when choosing a wallet. Take the time to research and assess your individual needs and preferences, ensuring that you select a wallet that aligns with your financial goals. With the right wallet in hand, you can confidently navigate the world of cryptocurrencies and enjoy the potential benefits it has to offer.