Unlocking the Mystery: How Cold Wallets Safeguard Your Cryptocurrency Investments!

The world of cryptocurrency has rapidly gained traction in recent years, capturing the attention of investors and tech enthusiasts alike. With the surge in popularity of digital currencies, understanding the importance of security has never been more critical. As cryptocurrencies become a lucrative investment, the need for robust security measures grows. This is where cold wallets come into play. Serving as a safe haven for your digital assets, cold wallets are an essential tool for anyone serious about protecting their cryptocurrency investments.

Understanding Cold Wallets

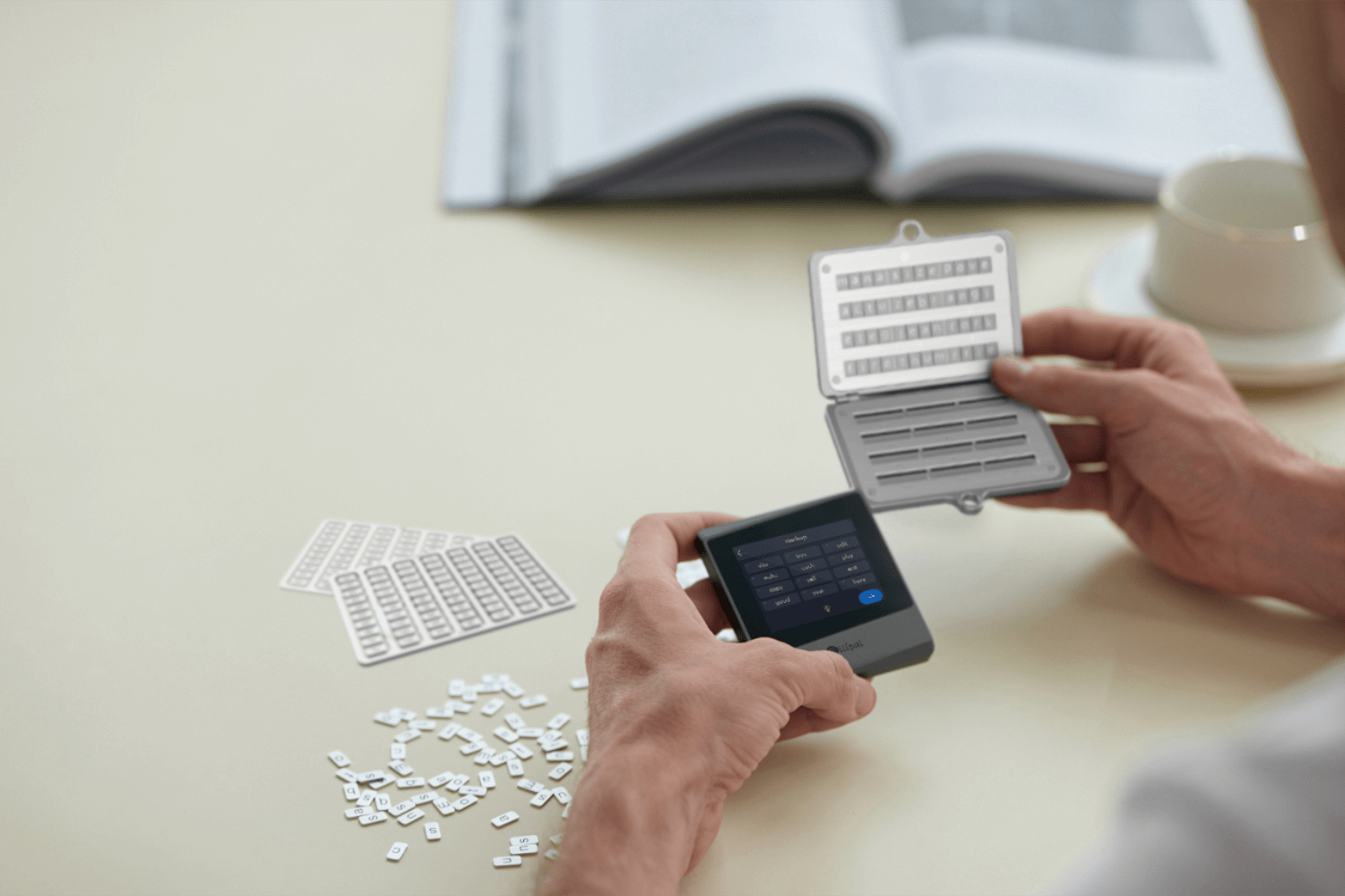

At its core, a cold wallet is a type of cryptocurrency wallet that is not connected to the internet, making it far less susceptible to cyberattacks. Unlike hot wallets, which are online and facilitate quick transactions, cold wallets prioritize security over convenience. There are several types of cold wallets, including hardware wallets and paper wallets. Hardware wallets are physical devices that securely store your private keys offline, while paper wallets are simply pieces of paper containing your keys printed out. Both options provide a higher level of security compared to their online counterparts, making them ideal for long-term storage of cryptocurrency. My friend, an avid cryptocurrency investor, has been using a hardware wallet for years, swearing by its effectiveness in keeping his investments safe from online threats.

How Cold Wallets Work

The technology behind cold wallets revolves around private keys, which are essential for accessing and managing cryptocurrency holdings. A private key is a unique code that allows you to send and receive digital currencies. In a cold wallet, these keys are stored offline, significantly reducing the risk of unauthorized access. Transferring cryptocurrencies to and from a cold wallet is a straightforward process. To move funds to your cold wallet, you'll generate a receiving address from the wallet, which is then used to transfer the desired amount from your hot wallet or exchange. When you want to make a transaction, you'll need to connect your cold wallet to a device temporarily, sign the transaction with your private key, and then return it to offline storage. The first time my friend transferred his Bitcoin to his cold wallet, he was overwhelmed by the simplicity of the process, noting how reassuring it felt to have his assets stored securely away from potential online threats.

Benefits of Using Cold Wallets

The advantages of utilizing cold wallets are numerous, particularly when it comes to security. Since cold wallets do not connect to the internet, they are impervious to hacking attempts that often target hot wallets. Additionally, cold wallets grant users complete control over their private keys, eliminating the risks associated with third-party storage solutions. This level of control is crucial, as losing access to private keys can result in permanent loss of funds. Cold wallets also offer protection against online threats like phishing attacks and malware, which are prevalent in the cryptocurrency space. A friend of mine experienced a phishing scam that almost cost him a significant portion of his investment. Ever since he switched to a cold wallet, he feels more secure, knowing that his assets are safeguarded against such risks.

Considerations When Using Cold Wallets

While cold wallets provide enhanced security, there are important factors to consider before committing to this storage solution. One of the most critical aspects is establishing a backup strategy. If your cold wallet is lost or damaged, and you haven't backed up your private keys or recovery phrases, you could lose access to your funds permanently. Additionally, cold wallets are not immune to physical damage, so it's essential to store them in a safe place. Another vital consideration is the security of your private keys. If someone gains access to your private key, they can control your cryptocurrency assets. My friend's experience emphasizes this point; after he had a close call with a fire in his home, he realized the importance of having multiple backups of his wallet stored in separate locations.

Strategic Use of Cold Wallets for Secure Investment

In summary, cold wallets are a crucial component in the security landscape of cryptocurrency investments. Their offline nature, combined with the control they offer over private keys, makes them a superior choice for long-term storage compared to online wallets. As cryptocurrency continues to evolve, it’s vital for investors to evaluate their security strategies and consider integrating cold wallets into their asset management. By doing so, you can ensure that your investments remain protected against the ever-growing list of cyber threats in the digital currency space.